e-treasury Kerala Registration and Challan Status Checking @ e-Treasury 2.0

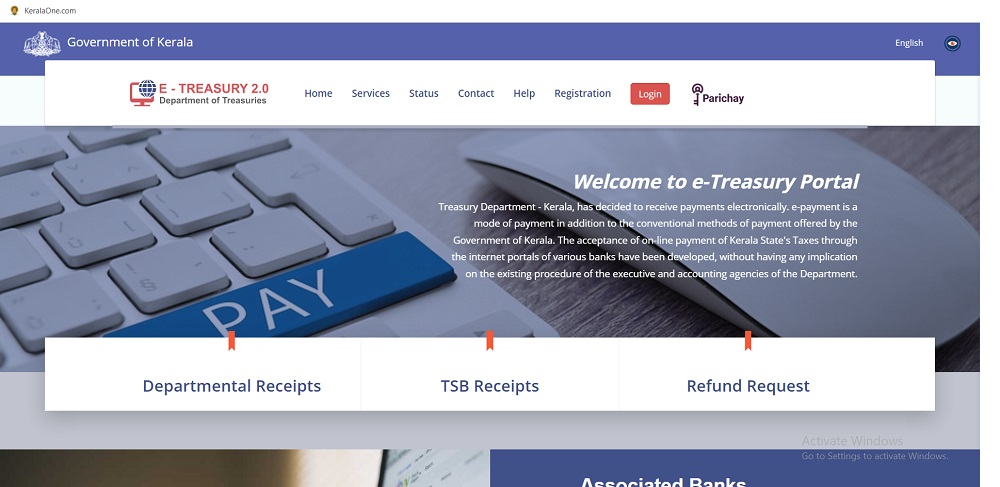

etreasury.kerala.gov.in: The Government of Kerala, e-Treasury has introduced a new facility of Registration and view challan status. e-payment is a mode of payment in addition to the conventional methods of payment offered by the Government of Kerala. The acceptance of online payment of Kerala State’s Taxes through the internet portals of various banks have been developed, without having any implication on the existing procedure of the executive and accounting agencies of the Department. To avail of this facility, the taxpayer is required to have a net-banking account in any bank. Now the online treasury challan payment is easier through the e-treasury 2.0 portal.

E -treasury Kerala Content

- How to Register in e-Treasury Kerala

- e treasury Login

- e-treasury Search Challan Status

- Online Payment Step by Step Guide in Malayalam

- etreasury e-payment Facility

- Kerala e-treasury Refund Request

- e-treasury Kerala Available Banks

- e-treasury Bank Login

- Apply for Income Tax Exemption Certificate

- e-treasury Kerala Contact Number

How to Register in e-Treasury Kerala

To pay challan through the e-treasury website, peoples have to register online before paying the amount. If you are already registered can log in directly to the e treasury Kerala gov in login page using the User ID and Password received at the time of registration. Follow the below-given instructions to register in e-treasury website.

- Go to the Kerala e-treasury 2.0 portal – etreasury.kerala.gov.in

- Click on Registration on the right top of the page and Select Public / Bank

E Treasury registration 2.0

- Please enter contact information,

-

- Full Name (max 75) * – Fields marked with (*) are compulsory.

- District *

- Town/City/Area/Locality*

- Road/Street/Post Office *

- Premises/Building/Village *

- Flat/Door/Block No. *

- PIN *`

- Contact Number (LandLine) STD or Phone No or Mobile

- Email ID1

- Alternate Email ID1

- PAN Number

- Create a User Name and Password and Click on the Register button.

- Check entered details before registering details.

- After registration, you can log in to the e-payment portal using the User ID and Password entered at the time of registration.

e treasury 2.0 Login

If you are already registered, you can log in to your account through e treasury.kerala.gov.in login portal. Enter the user ID and Password received at the time of registration.

- Click on “Login”,

- Enter the User name and Password created at the time of registration

e treasury 2.0 log in

e-treasury Search Challan Status:-

To check challan status after paying the amount through the e-treasury portal Kerala, follow the following instructions.

- Go to the Kerala e-treasury website

- Click on Status and select “Challan Status”

- Select options GRN / Department Ref. Number

- Enter the number and Click on “Search”

e treasury 2.0 challan status

Note:- Please enter either GRN or Bank CIN or Bank Payment Reference No.

e treasury Online Payment Step by Step Guide in Malayalam

All electronic fund settlements of the Government of Kerala are possible through e-Treasury, the official payment gateway of the Government of Kerala. The challan will be payable from anywhere at any time through e treasury online payment into any government department in Kerala. Click on the below-given button to download the e-treasury online challan payment step-by-step guide in Malayalam

etreasury e-payment Facility

Now Kerala treasury e-payment facilities are available in the below-given government departments in Kerala.

- Kerala Motor Vehicle Department

- Food Safety Department

- Public Service Commission

- Mining and Geology

- Secretariate General Administration

- Electrical Inspectorate

- Drugs Control

- Factories and Boilers

- Registration

- Service Plus

- Excise

- SSDG

Kerala e-treasury Refund Request

To refund the paid amount through e-treasury the payer should have a net banking account with any of the banks listed below. Follow the below-given steps to apply for the refund facility through the website.

- Click on Services and select “Refund Request“.

- Enter GRN and the Amount to be refunded.

- Select Search GRN. fill out the form and submit it.

- Check the details entered into the form before submitting.

Kerala e treasury Refund Status

To check the status of the refund application follow the below-given steps.

- Click on the official status link – etreasury challan refund status

- Enter the Refund Request Number / GRN and click on the Search button.

- The status of the refund request will be displayed on a new screen.

- If you entered the wrong refund request number click on the Exit button.

e treasury Kerala Available Banks

The government of Kerala introduced the e-payment system to accept online payments of Kerala State’s Taxes through the internet portals of various banks. To avail of this facility, the taxpayer is required to have a net-banking account with any of the banks listed below.

- Bank of Baroda

- Bank of India

- Canara Bank

- Federal Bank

- IDBI Bank

- INDIAN BANK

- Indian Overseas Bank

- Punjab National Bank

- QR CODE PAYMENT GATEWAY

- State Bank of IndiaUnion Bank of India

Other Payment Options - Payment Gateway with 54 other Banks, Debit/Credit Card, UPI, QR Code, and ePOS

e-treasury Bank Login

To log in to the e-treasury banks you need to register in the e-treasury with bank account details. If you are already registered use the User ID and Password received at the time of registration to log in. Follow the below-given steps to log in to e-treasury banks.

- Go to the treasury bank login page

- If you are already registered with your Bank account details, enter your User ID and Password to log in.

- For new users click on “New Registration”

- Fill in the required details (careful to enter the IFSC code) and click on the Save Button.

Apply for Income Tax Exemption Certificate

Donation to Chief Minister’s Distress Relief Fund (CMDRF) facility is available through the e-treasury portal. Income Tax exemption is applicable to the Amount donated to CMDRF. To donate Click on “TSB Receipts” enter the Treasury Savings Account Number 701010200000080 and select Internet Bank or Debit/Credit Card as the Payment mode.

e-treasury Kerala Contact Number

| Contact Details | |

|---|---|

| Address | Directorate of Treasuries Pattom Pattom Palace P.O Thiruvananthapuram – 695004 Kerala, India |

| Toll-Free | 1800-4255-176 (5 lines) |

| Phone | + 91 471 – 2323963 / 2322712 |

| Mob. | + 91-9496003023 |

| etreasuryofficer@kerala.gov.in | |